MADC technical indicator:

It’s time for the daily technical teaching session again. Today I want to share a trading strategy with you: MADC technical indicator.

Many investors are not familiar with the MACD technical indicator. This is what I found when I was helping you analyze individual stocks.

So today’s course will be of great help to you in improving your stock knowledge. This skill will definitely help you make money in the stock market. These contents are also based on my experience accumulated over the years. Next, let’s learn

First, let’s take a look at what MACD is!

The MACD indicator explained

Classed as a momentum indicator, the MACD is based on the relationship between two moving price averages (MA) of the same asset’s price. Conceived by investment manager Gerald Appel in 1979, the MACD has risen to become one of the most popular technical trading indicators in use today.

MACD is a very intuitive volume indicator!

Reference about MACD indicator! Please read the following picture carefully!

Large volume at the bottom is a bullish signal!

In the contrary, if the volume increases at the top, it is a bearish signal!

The increase in volume at the top means that the turnover rate of funds has increased. The increase in trading volume is because a large amount of funds have fled, and the market is about to fall! Right? Yes

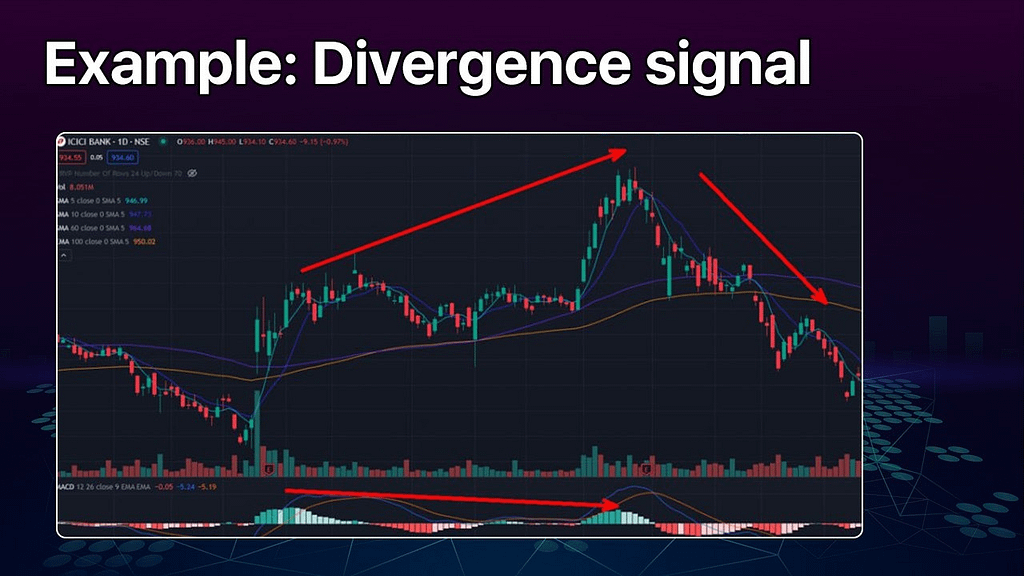

Example: Divergence signal in above picture

Yes, to put it simply, trading volume is the size of buying funds, that is, the transaction chips. MACD is the most intuitive volume indicator. When the bottom volume increases, the stock price rises, and when the volume shrinks, the stock price falls!

Trading is a game of funds! You must always pay attention to the flow of funds! The standard for measuring the flow of funds is the MACD indicator!