Let us know how to predict short-term of stocks rises and falls!

key knowledge and methods of short-term prediction of stock rises and falls

Today, I will explain to you the key knowledge and methods of short-term prediction of stock rises and falls that I personally summarized. Please read carefully!!! But before that, let’s review the Friday’s-06-Sep-24 market!

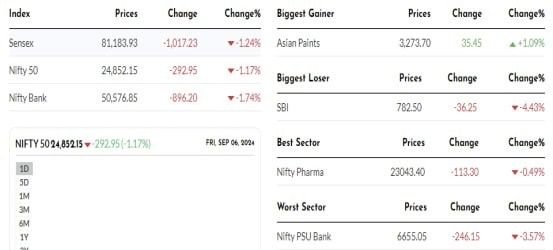

Friday, the stock market is experiencing a downward trend, with 38 sectors showing a decline and no sectors showing any advancement. The BSE 500 index has recorded a negative one-day return of -1.27%, indicating a bearish sentiment. The top losing sectors include NIFTYPSUBANK, S&P BSE Telecommunication, and BSEPSU, with specific stocks like Indian Bank and Vodafone Idea recording significant losses. The healthcare sector has shown some resilience, while the NIFTYPSUBANK sector has seen a complete decline.

On the other hand, the healthcare sector (BSE HC) has shown some resilience with a ratio of 0.58, indicating a better performance compared to other sectors. However, the NIFTYPSUBANK sector has a ratio of 0.00, suggesting that all the stocks in this sector have declined today.

Investors are advised to closely monitor the market and make informed decisions based on the current trends. With the ongoing pandemic and economic uncertainties, it is crucial to stay updated and cautious while making investment decisions.

On September 5, 2024, the trading activities of Domestic Institutional Investors (DII) and Foreign Institutional Investors (FII) showed contrasting trends:

Foreign Institutional Investors (FII) Data:

Foreign Institutional Investors (FII) experienced a net inflow of ₹2,970.74 crores. They bought shares totaling ₹14,803.18 crores and sold shares worth ₹11,832.44 crores. This reflects a positive sentiment from FIIs, who were net buyers and increased their investment in the market.

2.Domestic Institutional Investors (DII) Data:

Domestic Institutional Investors (DII) had a net outflow of ₹688.69 crores. They purchased shares worth ₹17,446.87 crores but sold shares worth ₹18,135.56 crores. This indicates that DIIs were net sellers on this date, reducing their market exposure.

Overall, both domestic and foreign investors were active buyers on this day, with DIIs making a more substantial net investment compared to FIIs.

The above is the market overview on Friday. Next week we will make some designated layouts according to the current market situation. And I have a good news for you. Many of the stocks we have laid out before are insider stocks participated by institutions. They are expected to rise sharply next week. We will make a profit of more than 30%. Please pay attention to the information of the group in time!!!

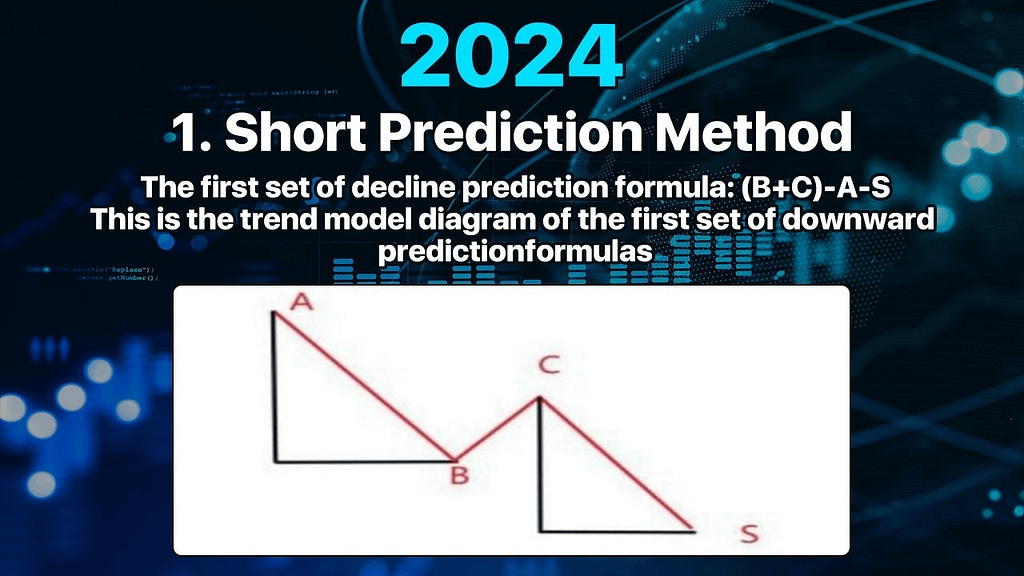

Now let’s start today’s meeting study. In order to make it easier for everyone to save records, I will teach in the form of pictures. Please save them and study them repeatedly!

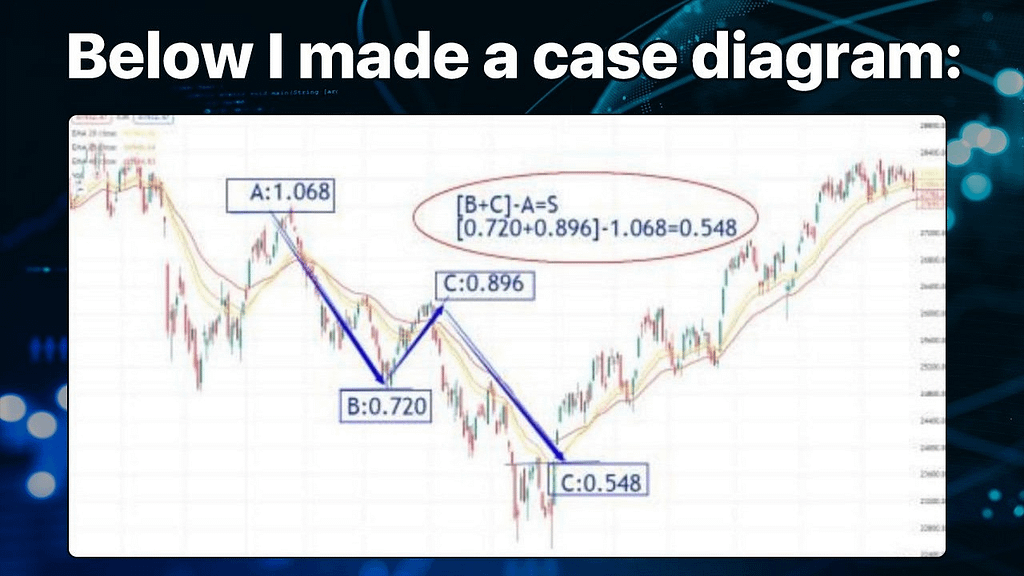

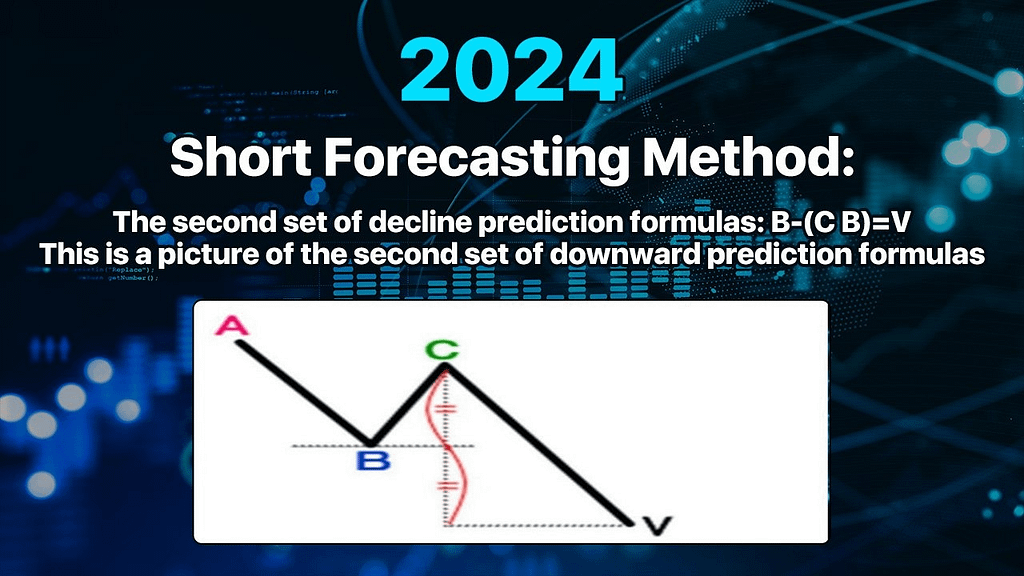

Yes, this kind of market situation is generally called a falling relay, indicating that the price range between B and C is accumulating momentum for further accelerated decline!

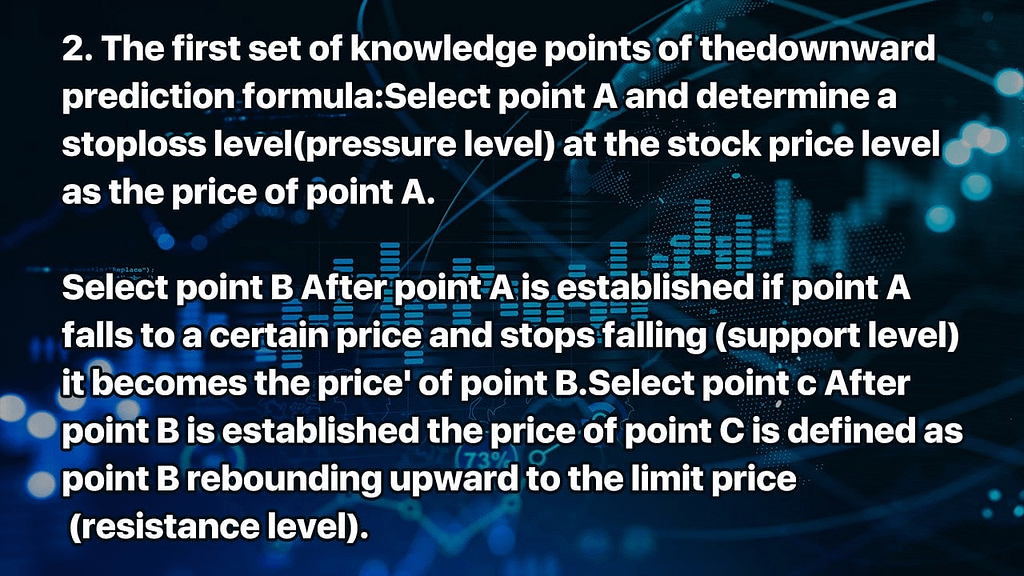

In the falling relay, from A to B, due to the rapid decline, many retail investors were killed. When retail investors observed that the stock price stabilized from B to C, and when the stock price reached C, many retail investors would further add chips, then they would be further killed! This is the usual operation method used by institutions!

So how to judge whether the interval from B to C is a bottoming rebound or a downward relay! You can use the formula on mutation!!!

In fact, many people like to buy at the bottom, especially after the stock price has fallen sharply, blindly buy at the bottom! Buy at a low price and sell at a high price, this is not wrong in logic! But what we need to confirm is whether the bottom area really exists!

This calculation formula can not only intuitively reflect the buying point, but also predict the stop loss point!

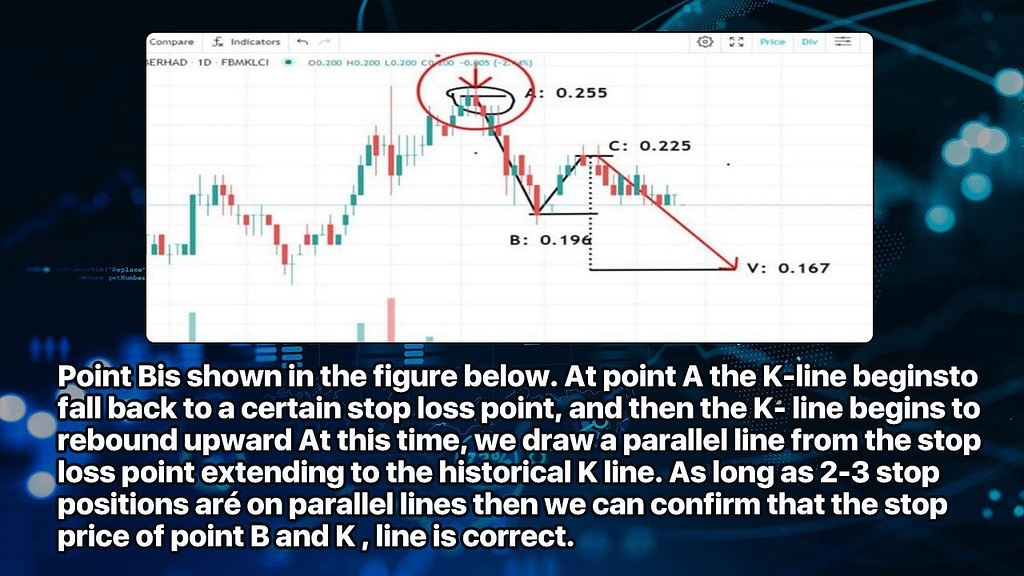

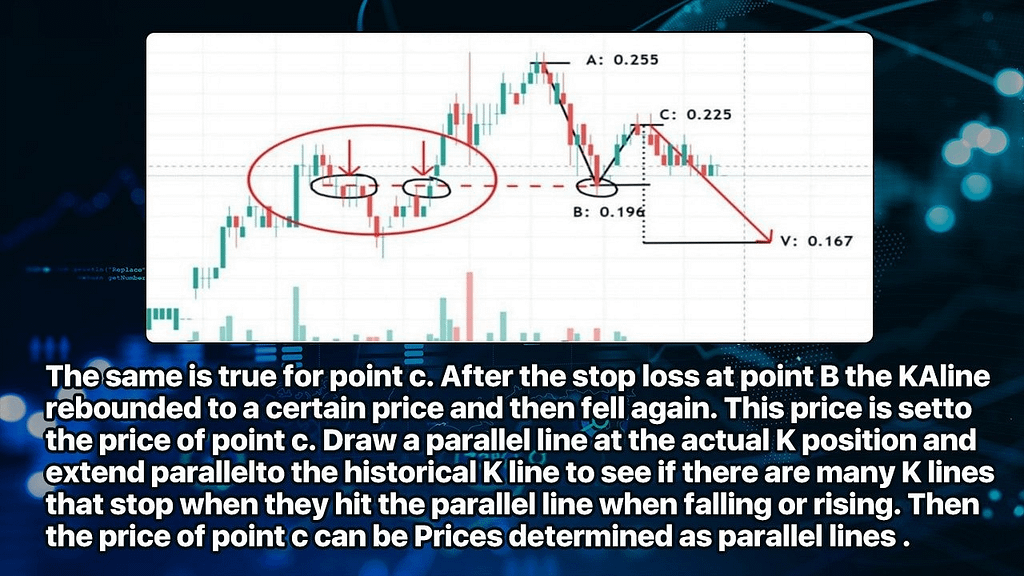

We can observe whether the K-line from B to C exceeds 10 days! To choose the appropriate calculation formula

⭕️Today’s technical sharing ends here.

Next session will be a crazy. We recommend to visit https://https://techtunecentre.com/ & share to others also to get benifical with goody – goody un-imagine such contents.